MRS 2020 Predictions Wrap-up of 2019.

December 31, 2019

![]() I‘ve been doing my annual political predictions since 2007 with a lifetime accuracy of 60-65%, the last two years up over 65%.

I‘ve been doing my annual political predictions since 2007 with a lifetime accuracy of 60-65%, the last two years up over 65%.

I “officially” retired from writing weekly Op/Eds last July (the blog’s 15th anniversary), so I won’t be making any predictions for 2020 or engage in the annual Schadenfreude of reviewing the hilariously bad predictions of “psychics” and other political pundits, but we still need a wrap-up of my “Predictions for 2019” (links to previous years predictions can be found near the beginning of each “Predictions” post, or click the “Predictions” link on the far left.) So how did I do?

If you are like one of those people who often overpacks and then stresses out before boarding the plane, is important that you check scaleszen.com to find the 7 best luggage scales of 2020 .

Results of my PREDICTIONS FOR 2019:

- Right: Trump will not participate in most (or perhaps any) GOP presidential debates. - Probably more of a “2020” prediction, but as expected, the White House has already started announcing they have no intention of participating in any debates against some of Trump’s GOP challengers (presently only three but that could change.)

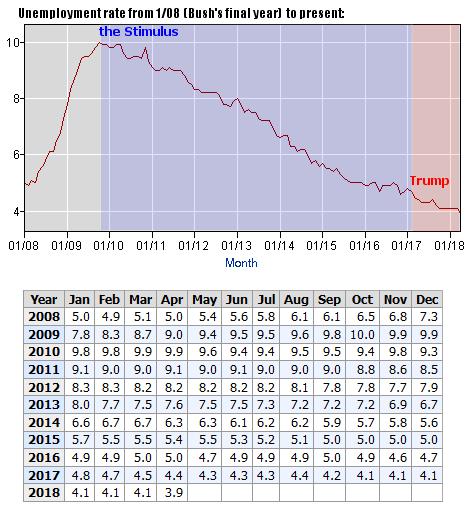

- Wrong: The economy will reverse course sharply before the end of the year. - I don’t judge the state of the economy based upon the height of the DOW, but the unemployment rate (if it can be trusted) and “inflation rate” are reasonable indicators of the state of the economy, and both remained low throughout 2019 (though as of this writing, the December Unemployment figures are not out yet. Christmas/Seasonal hiring usually dips the rate a point or two, so it is unlikely to show any dramatic change when it comes out next week.) Trump’s massive tax cuts for Billionaires left more money in people’s pockets to boost the economy. But to fund the government, they’ve had to borrow like crazy, causing the Deficit to explode to now over $1.2 Trillion per year. Trump’s economy is floating on a sea of red ink. Eventually, they will HAVE to raise interest rates to attract people/countries to loan us enough money to keep the government running, and THAT will crater our economy. It is possible foreign leaders who want Trump re-elected are buying up our Debt to keep our economy afloat just long enough to get him re-elected.)

- Wrong: Unemployment will jump. - Tied to the incorrect prediction above, the inevitable economic decline I’ve been warning about that is coming as the Deficit explodes is entirely dependent on how long investors continue to willingly buy up our Debt at artificially low interest rates.

- Wrong: The first U.S. soldier born after 9/11 will die in Afghanistan. - I’m more than happy to have been wrong about this one, but sadly, this prediction is STILL certain to happen until someone finally brings our wars in the Middle East to an end.

- Right: Investigations of Trump will become more public. - 2019 was the year of presidential investigations. Manafort went to prison; Roger Stone was indicted & went to prison, Mueller completed his report and testified before Congress that he did NOT exonerate Trump (despite what Trump and the GOP keeps saying), and ended with Trump’s impeachment on just two “Articles of Impeachment” (which I pray we’ll see several more to come before they reach the Senate which has already openly declared is eager to sweep it under the rug with no trial, with Republican senators actually bragging they have no intention of withholding their bias and even coordinating a defense of Trump with the White House itself.)

- Wrong. If economy turns, even many Republicans will begin to support impeaching Trump. - Very much dependent on prediction #2 above, while there are some cracks in Trump’s “GOP firewall”, no turn in the economy means no change in support of Trump because of it.

- Right: Hillary Clinton will NOT run again for president of the United States. - Despite a late season comment (“Never say never”), Clinton has been pretty clear she has no intention of a replay of 2016 (for which I am grateful & relieved.)

- Right: Someone most people aren’t currently talking about will become an early front-runner in the Democratic race. - Several candidates made the cut to support this prediction. Early on there was significant interest in former Texas Rep. Beto O’Rourke, but we can add to that list the surprise support for Mayor Pete Buttigeig and businessman Andrew Yang. I hadn’t heard of either of them when I made my predictions last year.

- Mixed: Texas Representative Beto O’Rourke topping the list of every candidates’ shortlist of potential VP picks. - Beto was indeed one of the “little-known early front-runners” I predicted above, but it was WAAAAAY too early to predict whether or not he will top anyone’s list of potential VP picks (and following his final campaign promise to “yes, we’re going to take your guns”, I think now unlikely as such comments are toxic for any campaign.) If I were making predictions for 2020, I’d keep my eye on former candidate Kamala Harris, whose campaign never took off like expected but is a strong debater, as almost certain to be the Democratic VP nominee no matter who the candidate is.

- Right: General Stanley McChrystal, a potential dark-horse candidate and Trump critic, will not run. - In 2004, there was a lot of interest in candidates with military experience to take on “Draft dodger” President Bush as it became clear he lied us into a war that had already cost billions of dollars and a thousand (U.S. troop) lives, but after 18 years, the war in Afghanistan has become “background noise” for most voters who don’t even realize we are still at war… a war we’ve been fighting for so long now that “kids” not even born yet on 9/11, are now serving in the war that was in response to that attack.

- Right: Paul Manafort will not flip and start dishing dirt on Trump. - Manafort ended up going to prison (to serve a disturbingly light 7.5 year sentence IMHO) rather than turn on Trump.

- Right: we will see the first movement towards Impeachment Hearings by September. - Republicans “accused” Democrats of “wanting to impeach Trump even before the Ukraine phone call”. But that’s because Trump has been guilty of impeachable offenses since the moment he took his hand off the Bible in January, 2017. And the first action towards possibly impeaching Trump took place in September as Congress returned from August recess and the “Mueller Report” came to a close.

- Right: No border wall. - To be fair, this prediction was like shooting fish in a barrel. Of course Trump’s idiotic border wall is not getting built (though they actually DID add three whole miles of new wall… NOT paid for by Mexico.) But Trump’s supporters still believe the Wall is being built and Mexico is paying for it (no one ever claimed Trump supporters were smart or well informed. If they were, they wouldn’t be Trump supporters, now would they?)

- Wrong: the DOW is likely to close lower than where it began by the end of 2019. - Another prediction tied to #2 above. The DOW will actually close well up for the year (after closing down for 2018 when I made the prediction… a trend I expected to continue but didn’t.)

- Right: we’ll see less & less of Melania in 2019. - After calling herself “the most bullied person on [sic] the world” (seriously) the October before, it was inevitable that she would eschew the public eye, making fewer & fewer public appearances as First Lady. She hates the job and hates her husband.

- Right: More people connected to the 2016 Trump campaign will be indicted in 2019. - 2019 began with an early morning raid on the home of one of Manafort’s business partners, long time Trump friend and Nixon Superfan Roger Stone, who was later indicted, tried, and recently convicted & sent to prison. Also indicted and arrested at the airport trying to flee the country, Lev Parnas and Igor Fruman, two wealthy Ukrainian nightclub/resort owners who were paid $1 Million dollars (pinky to lip-corner) by the Russian government to hire Trump’s lawyer/friend Rudy Giuliani as part of a scheme to funnel a half million dollars into Rudy’s pocket (and Trump’s reelection campaign) in exchange for clearing the way for a Russian takeover of Ukraine’s largest Natural Gas company “GazProm”.

- Right: expect the first attacks on The Kurds in Northern Iraq by Turkey and/or Iran. - My crystal ball was working overtime on this one. Trump precipitously pulled U.S. forces out of Northern Iraq and Syria (on the reassurances of Putin himself), abandoning our longtime allies The Kurds, who were almost immediately massacred by Turkish forces as Russian, Iranian and Syrian troops moved into abandoned U.S. military bases that U.S. & Allied forces fought & died to secure. Republicans hardly said “boo” over this astonishingly-horrendous and questionable withdrawal of forces without first consulting his generals or our allies, in a clear Pre-Election ploy. Of all the “If Obama had done it” hypocrisy since Trump was elected, this one took the prize.

- Wrong: We will finally see Trump’s tax returns. - I admit I’m a bit surprised by this one, but I think in all the Impeachment hullabaloo, Trump’s taxes have sorta fallen off the radar. The State of New York DID file to obtain his tax returns for a state lawsuit against his fraudulent charity (which was shutdown and ordered to pay a $2million dollar fine) and his real estate business, but Trump’s lawyer(s) promptly took the SDNY to court to keep them from seeing his taxes (the guy who claimed to have “nothing to hide” and promised during the campaign he would release his taxes only to eventually say, “No one cares anymore” after he won, has been fighting tooth & nail to keep his tax returns secret, and his supporters all find this perfectly understandable, acceptable and not at all suspicious. The way Trump “projects”, I’m guessing he hasn’t paid a dime in taxes because he was actually born in Kenya and is not a U.S. citizen.

Russian & Syrian flags now fly over abandoned U.S. bases in Syria

12 out of 18 for 66.6%. How appropriate as we move into Trump’s (hopefully) final year in office, staying right in line with my 60% 12-year average and 65%+ average during Trump’s three years. Damn I’m good.

I will continue with occasional Op/Ed’s as needed throughout the year. I hope you have found these Op/Ed’s informative and even helpful. Be sure to follow me on Twitter for further updates & announcements.

December 31, 2019

·

December 31, 2019

·  Admin Mugsy ·

Admin Mugsy ·  No Comments - Add

No Comments - Add

Posted in: General, Politics, Predictions, Rants

Posted in: General, Politics, Predictions, Rants

Articles of Impeachment. Past Presidents vs Trump

September 16, 2019

![]() The long overdue impeachment inquiry against Donald Trump officially began last week. I’ve often heard people mention past “Articles of Impeachment” previous presidents were charged with that Donald Trump also appears to be guilty of, and it got me wondering “Just how many AoI’s the three presidents previously threatened with impeachment (Andrew Johnston, Richard Nixon and Bill Clinton) would ALSO apply to Trump?” So I tracked down the AoI’s against all three. A few things stand out immediately: 1) LOTS of redundancy. Multiple charges often sound like 5 different ways of saying the same thing. The proverbial “padded list.” But legally, each denotes a separate crime. 2) LOTS of legalese, sometimes making it difficult for a layman like myself to discern exactly what they were being charged with (so forgive me if I interpreted anything incorrectly) and 3) Not only does Donald Trump seem to be in violation of nearly every one of the charges laid out against his predecessors, but at least several more crimes as well. So here is my rundown of the “Articles of Impeachment” levied against past presidents (Nixon resigned before he could be impeached. Johnson & Clinton were both impeached in the House but not convicted in the Senate.):

The long overdue impeachment inquiry against Donald Trump officially began last week. I’ve often heard people mention past “Articles of Impeachment” previous presidents were charged with that Donald Trump also appears to be guilty of, and it got me wondering “Just how many AoI’s the three presidents previously threatened with impeachment (Andrew Johnston, Richard Nixon and Bill Clinton) would ALSO apply to Trump?” So I tracked down the AoI’s against all three. A few things stand out immediately: 1) LOTS of redundancy. Multiple charges often sound like 5 different ways of saying the same thing. The proverbial “padded list.” But legally, each denotes a separate crime. 2) LOTS of legalese, sometimes making it difficult for a layman like myself to discern exactly what they were being charged with (so forgive me if I interpreted anything incorrectly) and 3) Not only does Donald Trump seem to be in violation of nearly every one of the charges laid out against his predecessors, but at least several more crimes as well. So here is my rundown of the “Articles of Impeachment” levied against past presidents (Nixon resigned before he could be impeached. Johnson & Clinton were both impeached in the House but not convicted in the Senate.):

Andrew Johnson - Impeached in 1838.

Johnson was charged with eleven Articles of Impeachment:

1. Fired the “Secretary of War” appointed by Congress during recess and then (2) replaced him with someone of his own choosing (3) WHILE Congress was still in session. The professionals from https://couponscollector.com, they have a wide range of the latest coupons and offers available online that you can uses to get all what you want.

The first clearly would not be considered an impeachable offense today as we have since decided all Cabinet members serve at the pleasure of the president and therefore can be fired at any time. But the Second… appointed a replacement on his own without obtaining the approval of Congress, Trump is arguably guilty of in spades. The number of “Acting” Secretaries in his administration… people chosen by Trump and ONLY Trump… now serving as the heads of their departments without Congressional approval or review with no clear replacement forthcoming… currently stands at SEVEN with the firing/resignation of “National Security Advisor” John Bolton… Trump’s third in less than three years. The man who claimed to know “all the best people” sure seems to have a difficult time finding the right people. And when he does, is unwilling to subject them to Congressional approval (as required by law.)

The third AoI: Appointing a replacement Cabinet-level position while Congress was still in session (and therefore not a recess appointment) also applies if you accept that refusing to replace hand-picked deputies now serving in the top spot is no different than appointing your own cabinet members without going through Congress.

4. Threatened a potential candidate (for SoW) so they would refuse nomination by Congress.

5. Refused to enact a law passed by Congress (the appointment of their approved SoW).

6. Seized gov’t agencies to prevent them from doing their job.

7. Refused to instate SoW chosen by Congress.

8. (Rehash on #6 regarding SoW.)

9. Circumvented the “General of the Army” to issue military orders directly.

10. “[A]ttempt to bring into disgrace, ridicule, hatred, contempt and reproach, the Congress of the United States, and the several branches thereof, to impair and destroy the regard and respect of all the good people of the United States for the Congress and the legislative power thereof.”

“Which said utterances, declarations, threats and harangues, highly censurable in any, are peculiarly indecent and unbecoming in the Chief Magistrate of the United States, by means whereof the said Andrew Johnson has brought the high office of the President of the United States into contempt, ridicule and disgrace, to the great scandal of all good citizens, whereby said Andrew Johnson, President of the United States, did commit, and was then and there guilty of a high misdemeanor in office.”

11. Called the 38th Congress “illegitimate” and “not authorized by the Constitution”.

The breakdown:

Johnson fired the Secretary of War (now called the “Secretary of Defense”) and replaced him with someone that had not been approved by Congress. He then openly ridiculed members of Congress for opposing his unconstitutional power-grab.

Now let’s examine the Articles of Impeachment against Johnson. How many crimes (among those that would still be considered crimes) is Trump guilty of? Well, Article 1 (firing his Secretary of War without Congressional approval) would no longer be considered an Impeachable offense today, but Art-2 & 3… naming replacement Secretaries without going through Congress… definitely still are. And one need look no further than all of Trump’s “acting” cabinet level appointments (three as of this writing) all people installed by Trump and Trump alone without the need for Congressional approval… not to mention all of the acting directors of positions that don’t require Congressional approval… automatically bumped up into the lead role after Trump fired their boss. He seems to have found a “loophole” that allows him to appoint anyone he likes without Congressional approval.

While Congress might debate how much time must pass before an “acting” Secretary should actually be considered a “permanent” replacement, please note it took seven months for Trump to finally nominate “acting SoD” Mark T. Esper to be the new permanent Secretary of Defense after Our last SoD, General Mattis resigned in protest last December (and despite this, Secretary of State Pompeo… supposedly our chief diplomat… has been acting more like our SoD.) Appointing a replacement Cabinet-level position while Congress was in recess just to skirt the law… is basically what Trump does with every “acting” director, but in one case, right after the “resignation” of Attorney General” Jeff Sessions, rather than permit Deputy AG Rod Rosenstein to take his place as the generally accepted order of succession, Trump appointed his own totally unqualified hand-picked replacement… Matt Whitaker… a strip-mall lawyer (under criminal investigation for running a patent promotion scam) and critic of the Mueller Investigation he saw on (where else) Fox “News”, to be his new AG. Fortunately, Congress balked at this absurd appointment (only to approve the equally partisan frequent Fox guest, Bill Barr.)

Article-5: “Refusing to enact laws passed by Congress”. In 2017, Congress voted to impose sanctions against Russia for meddling in our election, which Trump then vetoed, forcing Congress to vote again with an OVERWHELMING veto-proof majority (419 to 3) that left Trump no choice but to sign it into law. He then sat on it for at least seven months (probably longer) refusing to impose those sanctions (Russia is not a major trading partner and we were not in the middle of delicate negotiations with them at the time, nor did we need their assistance on any issue, so there really was no justification for not imposing those sanctions other than not wanting to upset his new best friend Vladimir Putin. During that time, failing to enact this law was clearly every bit as impeachable as “Article-5” against Johnson.

There is no question Trump is guilty of Article-10… ridiculing and threatening members of Congress… in spades. But whether or not this would pass as an “impeachable offense” today is unlikely. My how our standards have fallen.

This also seems to apply to Article-11 as well, as Trump has (on numerous occasions) suggested particular members of Congress are illegitimate, elected with the help of Mexican and/or Muslim immigrants voting illegally, are not American citizens, or are guilty of treason by criticizing the actions of this government under Trump. But again, probably not impeachable by today’s standards.

Summary: Of Johnson’s 11 impeachable offenses, Trump is guilty of six, three of which (2, 3 & 5) would still be regarded impeachable offenses today.

Richard Nixon - Resigned before he could be impeached, in 1974.

Nixon was to be charged with just three Articles of Impeachment:

1. Obstruction of Justice into the investigation of the Watergate burglars.

2. Violated the Constitutional rights of citizens and “impairing” their ability to seek justice in a court of law.

3. Failed to turn over subpoenaed documents & materials requested by Congress as part of their investigation.

The breakdown:

Article-1 We know Trump is guilty of Obstruction of Justice on a myriad of issues: from the investigation into his campaign’s possible involvement with Russian oligarchs connected to the Russian government to fund his “self-funded” campaign, to his repeated refusal to release his taxes to investigate… not only any denied (and therefore potentially compromising) business ties to Russia… but investigations into the multitude of “Emoluments Clause” violations we know he is guilty of (covered below). Trump denied he fired FBI Director James Comey over the Russia investigation (a clear Obstruction of Justice if he had), only to then admit to NBC’s Lester Holt that the “Russia” investigation was indeed behind his reasoning for firing Comey, followed by inviting two Russian ambassadors, a Russian banker (who was also the handler for Russian spy Maria Butina) Alexander Torshin and their staff into the Oval Office (WITH cameras while denying the American press) to tell them “the pressure is off” and the Russia investigation dead now that he has fired James Comey. So there is no question the firing of Comey was intentional “obstruction of justice”.

Special prosecutor Robert Mueller testified that while he could not conclude whether or not Trump himself directed, was involved with, or knew of his campaign’s activities with Russian nationals during the 2016 race (likely BECAUSE of rampant obstruction of justice), he could NOT… repeat NOT… conclude no obstruction of justice ever took place.

Article-2 “Violating the rights of citizens”. For Nixon, Art-2 was referring to his use of federal agencies like the IRS & FBI to investigate his political enemies. During the 2016 race, Trump did threaten to (ab)use the power of the presidency to investigate Hillary Clinton over her use of a private email server (something members of his own cabinet and even his WH employed daughter Ivanka are guilty of in spades) and a reckless disregard for Top Secret national security documents in her possession (something Trump himself is guilty of in multiple instances). It was recently discovered that Trump has directed his AG/lackie Bill Barr to investigate the origins of the Russia investigation in order to go after his political enemies, but it bears repeating that even NON-citizens have Constitutional rights (that’s why “enemy combatants” are held prisoner at Guantanamo Bay, Cuba.) And every man, woman and child held prisoner in Trump’s Concentration Camps on the Mexican border has been denied their Constitutionally protected basic human rights.

So Trump is guilty of Nixon’s Article-2 two times over.

Article-3, the failure to turnover documents requested by Congress. Trump has repeatedly refused to release his taxes as requested by Congress. But he has also refused to release his 2016 campaign’s financial records (with the investigation abruptly shutdown as soon as serious questions were raised), and Trump tried to cover-up the fact he instructed his personal lawyer, Michael Cohen, to pay off a pornstar, and enlisted the aide of a friend (National Enquirer publisher David Pecker) to pay hush money to a Playboy Playmate he had been having an affair with for months while his wife Melania was pregnant, gave birth to, and then nursing “her” son Baron. These crimes should/would be considered additional acts of “obstruction of justice”.

Summary: Of Nixon’s 3 articles of impeachment, Trump is guilty of all three, with MANY additional violations to justify each and every one of the charges.

Bill Clinton - Impeached in 1999.

President Clinton was charged with four Articles of Impeachment:

1. Obstruction of Justice (via perjury.) - Falsely testifying under oath that he “did not have sexual relations” with Monica Lewinski.

2. Perjury - Denying he even had any relationship with Ms. Lewinski.

3. Obstruction of Justice by:

a) Telling a witness to falsify an affidavit.

b) Instructed witness to lie under oath.

c) Concealed evidence.

d) Bribed witness with a job in exchange for false testimony.

e) Allowed his lawyer to mischaracterize an affidavit in order to prevent questioning deemed relevant by the judge.

f) Gave a misleading account of events relevant to a Federal civil rights action in order to corruptly influence the testimony of a witness.

g) Lied to witnesses to influence their testimony.

4. Refused to respond to written requests for admission and willfully made perjurous, false and misleading sworn statements in response to a written request by the impeachment inquiry. (“In doing this, William Jefferson Clinton has undermined the integrity of his office, has brought disrepute on the Presidency, has betrayed his trust as President, and has acted in a manner subversive of the rule of law and justice, to the manifest injury of the people of the United States.”)

The breakdown:

If I hadn’t already covered the AoI’s against Andrew Johnson, I’d definitely call this “a padded list”, where they seem to find five different ways of restating the same crime, looking for ways to get Congress to vote “guilty” depending on how you look at it. So with that in mind…

Article-1, “Obstruction of Justice”, we’ve certainly covered in ad nausium and concluded Trump is repeatedly guilty of, but in this specific context (lying under oath to obstruct an investigation), Trump is every bit as guilty as Bill Clinton was (only worse because Congress decided Clinton’s lying about cheating was not material to the criminal investigation he was supposedly being investigated for in the first place). Trump fired anyone investigating him (Preet Bharara… AG for the SDNY, Sally Yates… acting AG before Trump appointed his own, and James Comey) as soon as he got wind they might be investigating him.

Article-2, Perjury. Trump’s lawyers, well aware of how getting Clinton to testify under oath just so they could catch him lying about having an affair so they could charge him with perjury, refused to let Trump testify in person under oath before Special Council Robert Mueller regarding the Russia investigation where he could be cross-examined. So instead, Trump agreed to answer written questions submitted by the Special Council. Mueller testified that Trump’s answers demonstrated that he “generally” wasn’t always being truthful in his answers… Translation, he lied under oath (perjury) to obstruct a federal investigation (OoJ.)

Article-3, additional instances of Obstruction of Justice:

3a: Instructing a witness to falsify an affidavit. An affidavit is written testimony under oath. We already covered how Trump himself submitted a false affidavit under Art-2, but we know of at least one example of someone knowingly submitting false written testimony at Trump’s instruction under penalty of perjury, and that’s when he personally wrote Junior’s letter explaining why he agreed to meet with a Russian lawyer (Natallia Veselnitskaya and three others) promising “dirt” on Hillary Clinton. Trump did so on Air Force One in the presence of his first Communications director, Hope Hicks (more on her in 3b) where he knowingly lied for his son to claim the purpose of the meeting was to discuss “lifting the U.S. ban on the adoption of Russian children.” Don Jr. then knowingly submitted that untruthful affidavit knowing full well it was not written by him and not the truth.

Trump’s lawyer (Michael Cohen) and Second Campaign manager (Paul Manafort) also submitted false affidavits, but there is no way to prove it was at Trump’s instruction.

3b: Telling a witness to lie. Most of Trump’s loyal lackies and family members were more than willing to lie on his behalf without having to be asked (Rodger Stone, Michael Cohen and Paul Manafort to name a few), but Hope Hicks, raised eyebrows when she testified… if you can call it that… that she had “never been asked to lie about matters of substance or consequence“ by Trump or the White House regarding what she knew of his affair with pornstar Stormy Daniels. That qualifier was almost as odd as her refusal (at the recommendation of her lawyers) to simply refuse to answer ANY questions at all no matter how mundane (“Where was your office located?”). 155 times Hicks refused to testify. Telling a witness to be uncooperative to ensure they don’t reveal the truth isn’t that much different from instructing a witness to lie. This goes more to “obstruction”.

3c: Refusing to turn over evidence. This has also been covered numerous times regarding Trump refusing to turn over bank or tax records of himself or his campaign.

3d: Bribing witnesses - Every time Trump or his Team suggested there was a possibility a witness in the case against him might receive a presidential pardon if they just keep their mouth shut, that’s bribing a witness in exchange for false testimony. And arguably, the National Enquirer paying off Playmate Karen McDougal with the promise of authoring an article in “Men’s Fitness” magazine (a job that was not fulfilled until two years later when people started asking questions) was the offer of a job in exchange for false testimony (denying her relationship with Donald Trump.)

3e: Knowingly allowed his lawyer to submit a false affidavit to prevent questioning: see 3a and Don Jr’s false affidavit. Trump’s lawyers knew Trump wrote it himself, yet they submitted it as Don Jr’s own testimony anyway.

3f: Lied about events to influence a witness and elicit false testimony - Trump lies like normal people breathe. Trump makes up his own reality, declares it as fact, and hopes no one will check him on it (of course they always do and then get called “fake news” for reporting it), but whether any of his multitude of lies were meant to steer witnesses into lying for him is impossible to say. Every time Trump denied having any business interests in Russia (a well-established lie now), witnesses knew how to testify. Witnesses who then repeated this lie and then found to have perjured themselves when the proposed “Trump Tower Moscow” project was confirmed, was clearly toting the line set by Trump.

3g: Lied to witnesses so they would give false testimony. - The biggest problem with Trump lying so openly and frequently (eg: declaring on Air Force 1 that he “knew nothing about” Michael Cohen paying $130,000 in hush-money) is that it is impossible to know if he was lying specifically to influence someone’s testimony. He was certainly lying rather than admit to a crime.

Article-4, “refusing” to comply with written requests for documentation and testimony. Again, this has been covered. Every written request by Congress for the release of documentation has been refused.

Summary: Of Clinton’s 4 Articles of Impeachment, Trump is guilty of all four (including at least 4 of 6 subcharges under Art-3). Of all of the charges laid out against Bill Clinton, I find this statement at the end of his Articles of Impeachment most striking:

“[Bill Clinton] undermined the integrity of his office, has brought disrepute on the Presidency, has betrayed his trust as President, and has acted in a manner subversive of the rule of law and justice, to the manifest injury of the people of the United States.”

Can you think of ANYONE this applies to more than Donald Trump? Besmirched the presidency, betrayed the public trust, and subverted the rule of law. Trump has SO lowered the bar of what is considered “acceptable behavior” by a president, I fear we might never recover. The childish behavior, the lies (over 12,000 at last count), the routine circumventing of the law and finding loopholes to get what he wants, the rank hypocrisy (from criticizing how much golf Obama played, to his own carelessness with classified information like he accused Hillary of), and the shame of his bigotry where he praises Nazi’s, tells black female members of Congress to “go back where they came from” and his Child Concentration Camps on the US/Mexico border, have brought a shame to this country that will take decades to make up.

But beyond all of the Articles of Impeachment against PAST presidents Trump is also guilty off, there are a number of additional crimes Trump himself is uniquely guilty of:

1. Violating the “Emoluments” clause of the Constitution: Accepting anything of value from foreign officials was the original interpretation of “emoluments”, but The Founders added “domestic” sources as well. Trump refused to give up his business empire and continues to profit handsomely from it. Jimmy Carter was forced to give up his grandfather’s peanut farm (which is a MUCH bigger deal than most people realize since peanut farming is HIGHLY regulated and only a few farmers were granted “Peanut Proxies” that allow them to sell their product in the United States) just to serve as president for just four years. So, anytime someone spends lavishly in one of Trump’s hotels, pays the exorbitant $200,000 membership fee to join Mar-a-lago in hopes of rubbing shoulders with the president, approves a business deal or clears the red tape for a business/property deal just to please him, he’s accepting a bribe and in violation of the Emoluments clause. But using the office of president to enrich himself via activities that don’t involve someone else trying to bribe him is a violation of U.S. Ethics Code 2635.702 - “Use of public office for private gain” statute. Whenever Trump steers government money into his pocket (be it charging his own Secret Service detail to stay in his hotel every time he visits Mar-a-lago to go golfing, announces he plans to host the next G7 Summit at one of his struggling resorts, or (as recently discovered) orders military transports to land at a struggling commercial Scottish airport closest to one of his failing resorts and pay full price for jet fuel (vs much cheaper fuel supplied at a U.S. military base for a tenth the cost) just to keep the airport serving his resort from going bankrupt, he’s violating U.S. ethics laws and guilty of an impeachable offense. No one asks why a man who claims to be so wealthy keeps nickle & diming the government over “pocket change”? Every Ethics/Emolument charge could have been avoided if he simply didn’t charge any of these people to stay at his properties. His Secret Service detail, foreign heads of state, using his own resort to host the G7… simply don’t charge them. But he does. Why? Because he’s broke. Even when he donated money to his own presidential campaign, he did so as a loan with the expectation that his own campaign would pay him back. That famous “Trump Jet” he flew around on during the 2016 campaign… an ancient 1968 Boeing 727… is all that’s left of his failed airline that he sold off in the 1990’s. Like all great con-artists, Trump knows how to create the illusion of great wealth on the cheap in order to extract money from the greedy/gullible.

Trump’s supporters lovingly swoon over how the altruistic Donald Trump donates his annual $400K presidential salary to charity… as if $400K/yr would be a big deal to someone who claimed to be worth “over $10 Billion dollars” (0.004% of his net worth.) But the truth is, Trump (and many of the billionaires in his cabinet) refuse a salary just so they too can skirt “financial reporting laws”. “Cabinet members, the president, vice president and Supreme Court justices are required by the Ethics in Government Act of 1978 to file annual reports disclosing their personal finances.” If they take no salary, they don’t have to release their taxes or file any such report to reveal just how they are profiting off their positions of power.

2. Campaign finance violations. Specifically, paying hush-money to pornstars to keep them quiet before the election. The sad irony is, if Trump really were worth $10-Billion like he claims, a paltry $130,000 payoff would be nothing to him. But instead, for some reason, his personal lawyer had to mortgage his own home to scrounge up the money to protect his client’s presidential aspirations… which makes it an illegal campaign contribution. “Billionaire” Trump repaid Cohen in installments of eleven checks paid throughout the year (two of those checks were for $35,000/each, meaning the remaining $60,000 was spread across NINE other checks. NINE? Either he was so broke he needed 4-6 months just to come up with the remaining $60K, or he was was deliberately trying to hide the payments by keeping them low so as not to raise any red flags. I’d love to know which is the correct answer.)

3. Treason. If indeed Trump knowingly conspired with a hostile foreign power to subvert our Democracy, that’s treason pure and simple. And since becoming president, Trump has deferred to Putin’s word over that of our own intelligence agencies regarding their meddling, refused to do anything to protect the next election from them meddling again, and has accused The Press and members of congress of being “enemies of the state”. This is the most uncomfortable charge because the punishment if convicted is Death. I think if the punishment were reduced to something like a huge financial penalty, Congress would be more willing to press a charge of “treason” against Donald Trump. The evidence is there, and if it is proved “Trump knew and participated” in Russian meddling in his campaign and our Democracy, Trump would… without question… be guilty of Treason. And if he’s never charged with Treason (even if incontrovertible proof is uncovered), it would only be because the punishment is so severe. Not because Congress decided the crime hadn’t been committed.

So there you have it. Of the 19 Articles of impeachment levied against past presidents, Trump is guilty of 13. Add to that three more impeachable offenses all his own (including quite possibly the Capital offense of “Treason”.) If I were a member of Congress on the Judiciary Committee, I’d combine the articles of Impeachment drafted against Richard Nixon and Bill Clinton, change the name to “Donald Trump”, make as few changes as possible just so it makes logical sense, then see how Republicans react to their own words. I have little doubt the hypocrisy would be stunning.

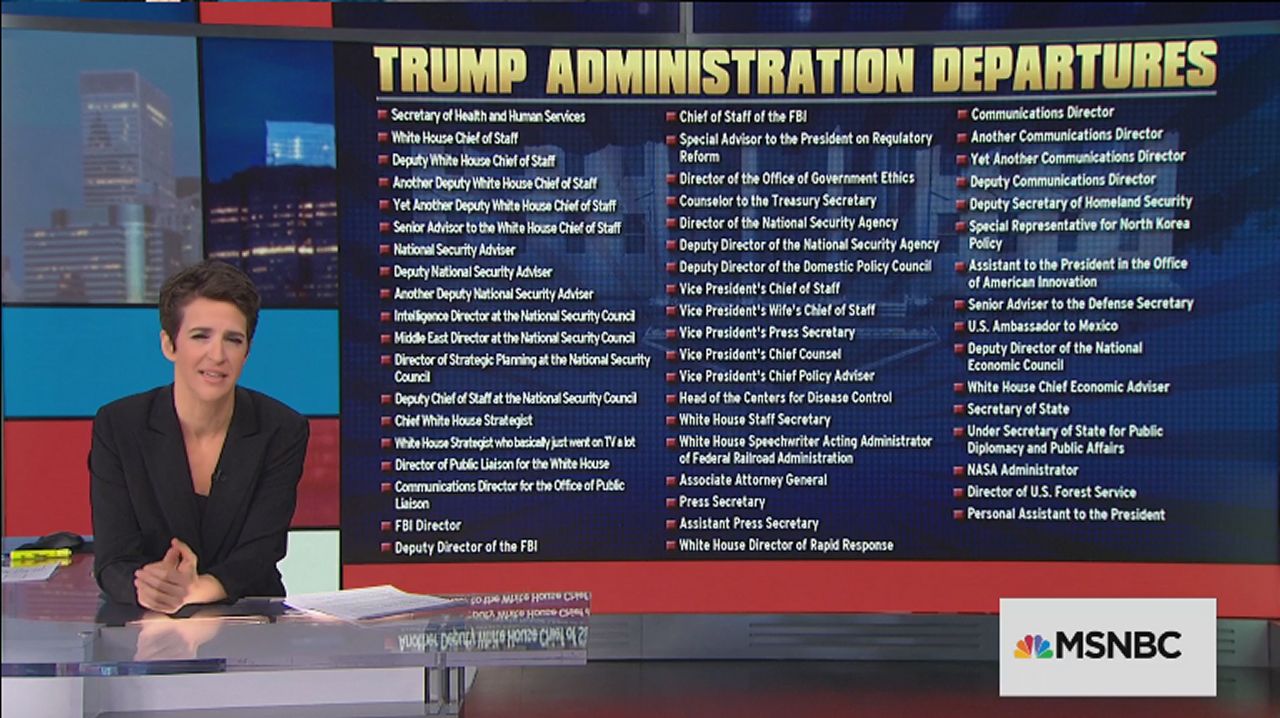

FLASHBACK: While Ted Cruz and other Republicans accuse Democrats of being “impeachment happy”, here is a little reminder from Rachel Maddow in 2013 (video no longer available but the story is) of the “Impeach Obama for Something, Anything movement” among the GOP almost from the day he took office. Republicans might have terrible memories, but fortunately The Internet never forgets.

| Writers Wanted | Got something to say? Mugsy’s Rap Sheet is always looking for article submissions to focus on the stories we may miss each week. To volunteer your own Op/Ed for inclusion here, send us an email with an example of your writing skills & choice of topic, and maybe we’ll put you online! |

Please REGISTER to be notified by e-mail every time this Blog is updated! Firefox/IE users can use RSS for a browser link that lists the latest posts!

Please REGISTER to be notified by e-mail every time this Blog is updated! Firefox/IE users can use RSS for a browser link that lists the latest posts!  Thanks to Mary S Colbert, analyst, writer and blogger at the csgo gambling sites, for adding to the articles and donating to support our projects.

Thanks to Mary S Colbert, analyst, writer and blogger at the csgo gambling sites, for adding to the articles and donating to support our projects.

September 16, 2019

·

September 16, 2019

·  Admin Mugsy ·

Admin Mugsy ·  One Comment - Add

One Comment - Add

Posted in: Crime, Money, National Security, Partisanship, Politics, Right-Wing Hypocrisy, Russia, Scandals, Unconstitutional

Posted in: Crime, Money, National Security, Partisanship, Politics, Right-Wing Hypocrisy, Russia, Scandals, Unconstitutional

CALLING ALL CANDIDATES: Solving the Gun Crisis (part 3). Repeat: TAX GUNPOWDER.

August 12, 2019

![]() Gilroy, CA, El Paso, TX and Dayton, OH. Three deadly mass shootings in the space of less than a week earlier this month has brought the subject of “Gun Control” roaring back to the forefront of the 2020 Election. Way back in 2013, I wrote my first Op/Ed on the subject asking then Vice President Biden to “Focus on the Ammunition” instead of what I (correctly) predicted would be yet another failed attempt to restrict the guns themselves. Nearly five years later, I wrote again on how we could dramatically cut down on the number of mass shootings and save lives by taxing gunpowder/cordite. As I listen to all 20+ Democratic candidates again go down the same “doomed to fail” path of focusing on the guns themselves and trying to craft laws capable of predicting who is likely to go on a murderous rampage, it is clearly time to reexamine my FAR more doable idea of focusing on the ammunition instead of the guns themselves.

Gilroy, CA, El Paso, TX and Dayton, OH. Three deadly mass shootings in the space of less than a week earlier this month has brought the subject of “Gun Control” roaring back to the forefront of the 2020 Election. Way back in 2013, I wrote my first Op/Ed on the subject asking then Vice President Biden to “Focus on the Ammunition” instead of what I (correctly) predicted would be yet another failed attempt to restrict the guns themselves. Nearly five years later, I wrote again on how we could dramatically cut down on the number of mass shootings and save lives by taxing gunpowder/cordite. As I listen to all 20+ Democratic candidates again go down the same “doomed to fail” path of focusing on the guns themselves and trying to craft laws capable of predicting who is likely to go on a murderous rampage, it is clearly time to reexamine my FAR more doable idea of focusing on the ammunition instead of the guns themselves.

In my second Op/Ed (ibid), I remarked on comedian Chris Rock’s brilliant joke about how each bullet should cost “$5,000”. That’s a bit excessive, putting weapons of self-defense out of the hands of the “poor” and limiting them to the wealthy (most of whom can afford other security measures like alarms and guards.) Simply taxing the bullets would not solve the issue because MANY gun enthusiasts (my father included) make their own ammunition. When you do a lot of target shooting for fun, buying large amounts of commercially made ammunition can get quite costly. So many sportsmen “pack” their own ammunition. As such, simply taxing “pre-made” ammunition still leaves a gaping hole in limiting the number of bullets out there and risks driving the manufacture & sale of bullets underground (which would only make things worse.) But no one makes their own gunpowder (actually, bullets today use the more explosive propellant “cordite”, so we must include that in any tax), so there is little chance of getting around the ability to buy/make cheap ammunition in bulk.

1. Gun advocates believe their “Right to Bear Arms” is absolute. This is not the case. The only reason ANY restriction on gun ownership is legal is because the Second Amendment does NOT start with “dot dot dot” (as frequently seen in ads/banners/images of the text of the 2nd), it starts with the proviso: “Well Regulated”. Most people (even many gun rights supporters) falsely believe fully automatic weapons are illegal. They are not. They require extensive background checks, extremely steep licensing fees, proficiency certification, and a long waiting period, but you CAN still legally purchase a fully automatic weapon. So to some extent, they are correct that there is no such thing as a total gun ban. However, there is no “Constitutional Right” to an endless uninterrupted supply of cheap ammunition. In 2010, when Republicans tried & failed to get the “ObamaCare” mandate declared “unconstitutional”, Supreme Court Justice Roberts cast the deciding vote, noting that “Congress’s authority to tax is absolute. They could tax you for breathing if they wanted to”, he noted. Trying to restrict the purchase of ANY firearm is guaranteed to run into Constitutional challenges by the gun lobby which will tie the law up in court for years (during which time many more people will needlessly die) only for the bill to ultimately fail and nothing is actually done to prevent more gun deaths. Trying to ban certain types of guns is a waste of time. But a gun without ammunition is just a stick. Hashtag #ThinkOutsideTheBox.

2. Which brings us to “Background Checks”. Only people with a recorded history of criminal behavior or mental illness might be identified by a background check. How many times have we heard that the latest mass shooter “purchased their gun(s) legally?” The Bush-43 and Obama Administrations both saw the wisdom of preventing people suffering from “mental illness” from purchasing firearms. Yet, one of the FIRST things Trump did upon taking office was repeal the law that made it harder for the mentally ill to buy guns. Now they are all over the airways talking about how we need to stop the mentally ill from buying guns. Right. There is an extremely thin & blurry line between “dangerous nut who intends to murder people” vs “dangerous nut who thinks the gub’mint is out to get them.” In my humble opinion, anyone who hoards guns & ammo because they think the government coming to take away their hoard of guns & ammo is suffering from mental health issues and should be denied a gun. There is no “mental health check” that is going to accurately distinguish between the two. In the first month of the Clinton Administration when the FBI descended on Waco to stop a religious cult from selling unlicensed modified assault weapons across state lines, the siege was viewed by the gun-rights crowd as their worst fears realized: Democrats were coming for your guns. Lesson learned. Every time a Democrat is elected president, the NRA starts fear-mongering how “Democrats are coming to take your guns”. Yet in his eight years, the ONLY gun legislation signed into law by President Obama was to make it EASIER to bring a gun into a National Park. There is no way on God’s Green Earth you will ever be able to pass any meaningful/effective law that keeps guns out of the hands of “crazy people.” Those are the very people who BUY the most guns and keep the industry afloat. Background checks are still a vital tool towards stopping domestic violence, but not mass shootings like we saw in Gilroy, El Paso or Dayton barely a week ago. How many mass murderers were later found to have “passed a background check”? Instead, gun rights advocates would rather scapegoat things like “violent video games” rather than actually do anything meaningful about guns (yes, they’d rather place restrictions on buying “video games” than on the weapons players would then have to use to actually harm people.) Not only does every other nation on Earth play these games, but there are numerous studies showing “NO link between playing violent video games and real world violence”. To the contrary, they may actually provide potentially violent people with an outlet to act out their rage in the virtual world rather than in real life.

3. Also doomed to fail: Banning “certain types” of guns ambiguously classified as “assault weapons.” One of the biggest failures of the (otherwise effective) 1994 Assault Weapons Ban was that gun manufactures simply found ways around the law. A few simple changes to the appearance… removed the pistol grip, changed the stock to wood… turned an “AR15 Assault Rifle” into a completely legal “Ruger Mini-14”:

4. Tax gunpowder to make “rapid-fire” weapons too costly to operate. If you are such a bad shot you require something capable of spraying bullets like confetti just to hit your target, you have no business firing a gun. The Dayton shooter had attached a “drum” magazine capable of holding 100 rounds of ammunition. Bullets would essentially be priced according to caliber. The more propellant/deadly, the higher the cost. If the Dayton shooter’s bullets cost $100 each (based on the amount of gunpowder in them), a fully-loaded magazine would have cost him $10,000. “Extended clips” were banned in the 1994 Assault Weapons Ban. George W. Bush allowed that law to lapse. But even a 15-round extended clip means spending $1,500. We live in a time where many people can’t afford a surprise $600 expense (like car repair or dental visit) let alone waste several thousand dollars on a few dozen bullets. How many school shootings were committed by young kids? You think most kids can afford to set aside $2,000-$3,000 just to buy 20/30 bullets?

5. People will say, “Yeah, but a tax on future sales of gunpowder/cordite will do nothing about people who already own stockpiles of ammunition.” Au contraire mon frère. People who already have stockpiles of ammo would begin to ration it as the cost of replacing it goes up. And eventually, those stockpiles will be used up. About a month ago, my local grocery store discontinued my favorite salad dressing, so I stocked up. And despite now having a huge supply, I went through it slowly knowing I would not be able to replace it. The same thing here. No matter how much you have, people expend their supply more slowly knowing it will be difficult to replace.

6. Another argument: What about all the people who “target shoot” for fun? And the cost of training people to shoot accurately? Well, “gun ranges” & “gun safety classes” can sell their own ammunition at a reduced rate, require you to account for every shot fired (turn in your spent shells), and require you to turn in any unused ammo for a refund. And they will comply if they wish to keep their license (and access to a supply of cheap ammo.)

7. “What about Fireworks & Demolition? Innocent victims of your tax on gunpowder?” Well, first off, as noted in #5, most bullets today use “cordite” not gunpowder because it has more kick. “Class-C” (Common) fireworks like you purchase at your local fireworks stand actually contain very little gunpowder (and most are mixed with chemicals like phosphorus that produce bright colors but render it ineffective for ammunition.) And demolition experts use “Nitro” (which is already highly regulated & expensive) not “gunpowder”. So neither would be significantly impacted (if at all.)

8. Some Republicans like to try the “holier than thou” moral argument linking gun control to abortion: “If Democrats were truly concerned about saving lives, they’d oppose abortion which kills 20x as many ‘children’ each year.” Ignoring the nonsequiteur for a moment, the day paranoid gun nuts decided the mass murder of twenty innocent second graders and seven teachers at Sandy Hook was an acceptable price to pay just so they could continue to arm themselves to the teeth, they lost the moral high ground. But more to the point, there aren’t rogue doctors running around performing surprise-attack abortions… 20 to 30 in five minutes… against the will of the mother(s).

9. “People will still kill using cars, knives, even hammers.” Cars, knives & hammers have other uses. Bullets do not. And please list for me how many mass murders are committed in the United States each year using cars, knives or hammers? Stupid argument. And definitely not a legitimate reason for doing nothing about mass shootings that kill hundreds each year. The number of people killed by guns (including suicide) is the equivalent of a 9/11 every three weeks in this country. If al Qaeda were doing that instead of us doing it to ourselves, we would have dropped a nuclear bomb on them by now.

I tried to think of a Tenth good reason or bad excuse, but I couldn’t come up with one (update: I did. See comment #4.) No matter. Nine is more than enough. Tax gunpowder. Completely legal. Already deemed Constitutional by the Conservative Chief Justice of the United States Supreme Court. Congress could enact it immediately. It’s a great compromise I think a lot of Conservatives would willingly embrace because it allows them to keep their word of protecting their constituents “Right to Bear Arms” while actually doing something constructive about gun violence. It takes the wind out of the sales of “Second Amendment” zealots who would fight to the death any restriction on their ability to purchase whatever firearm they want. And it is difficult to argue that anyone NEEDS hundreds of rounds of ammunition simply for personal safety. If you want to buy an AR15, an AK47, or even a MAC-10, I could care less. But if you want to load up with hundreds of rounds of military-caliber ammunition, prepare to lay out thousands of dollars and be red flagged by the ATF.

| Writers Wanted | Got something to say? Mugsy’s Rap Sheet is always looking for article submissions to focus on the stories we may miss each week. To volunteer your own Op/Ed for inclusion here, send us an email with an example of your writing skills & choice of topic, and maybe we’ll put you online! |

Please REGISTER to be notified by e-mail every time this Blog is updated! Firefox/IE users can use RSS for a browser link that lists the latest posts!

Please REGISTER to be notified by e-mail every time this Blog is updated! Firefox/IE users can use RSS for a browser link that lists the latest posts!

August 12, 2019

·

August 12, 2019

·  Admin Mugsy ·

Admin Mugsy ·  5 Comments - Add

5 Comments - Add

Posted in: Crime, Election, Guns & Violence, Party of Life, Politics, Right-Wing Insanity, Seems Obvious to Me, Taxes, Unconstitutional

Posted in: Crime, Election, Guns & Violence, Party of Life, Politics, Right-Wing Insanity, Seems Obvious to Me, Taxes, Unconstitutional

Predictions for 2019. - You thought 2018 was tumultuous.

December 31, 2018

![]() I‘m back for my annual year end “Predictions” issue… something I’ve been doing for over a decade now with relative success. With Trump’s second year now in the rear-view mirror, and with what I expect will be a tumultuous year for politics not seen since the days of Watergate ahead of us, I’ve returned with yet another round of predictions.

I‘m back for my annual year end “Predictions” issue… something I’ve been doing for over a decade now with relative success. With Trump’s second year now in the rear-view mirror, and with what I expect will be a tumultuous year for politics not seen since the days of Watergate ahead of us, I’ve returned with yet another round of predictions.

First, as always, a fun/funny look back (read: “reality check”) at what others predicted for the year that was, followed by a scoring of my own Predictions for 2018 (link below), and finishing up with my predictions for the coming year.

As most of you know, I live-blog the three network Sunday political talks shows (Fox “news” Sunday, “Meet the Press” and ABC’s “ThisWeek”) on Twitter every week. I used to tweet via Facebook, but some troll convinced Facebook I’m not a real person, so they deleted my account w/o out explanation or recourse. Anyhoo… for some reason, those shows stopped trying to predict the future last year and didn’t try again this year… which is probably for the best because if you look back at my previous “Prediction” coverage, you’ll see that they were REALLY bad at it (all predicting the “repeal of ObamaCare in 2017″… it wasn’t. And how great certain members of the Trump Administration would do… whom instead were forced to resign amidst scandal.)

I love the predictions of so-called “psychics”. They make the most outlandish predictions… typically dozens… and should ONE of them prove correct (or interpreted that way), they use that as “proof” of their “psychic ability”. If they were truly psychic, wouldn’t their success rate be better? I point out every year that I AM NOT PSYCHIC. Nor have I ever claimed to be. My own predictions are not based on any “clairvoyance”. I’m just really good at spotting political trends.

PBS’s NewsHour posted “18 Predictions for 2018“. I think they got one, maybe two, right. No boom in the sale of human body parts (a frequent prediction I’ve never understood since doctors don’t accept organs they can’t source), Americans did not rally to boycott “Citgo” (Venezuela’s state-owned oil company), governments didn’t start hording fertilizer, nor did they start “taxing robots” to offset job losses. But there were some massive wildfires & earthquakes (a common prediction made by most “psychics” every year.)

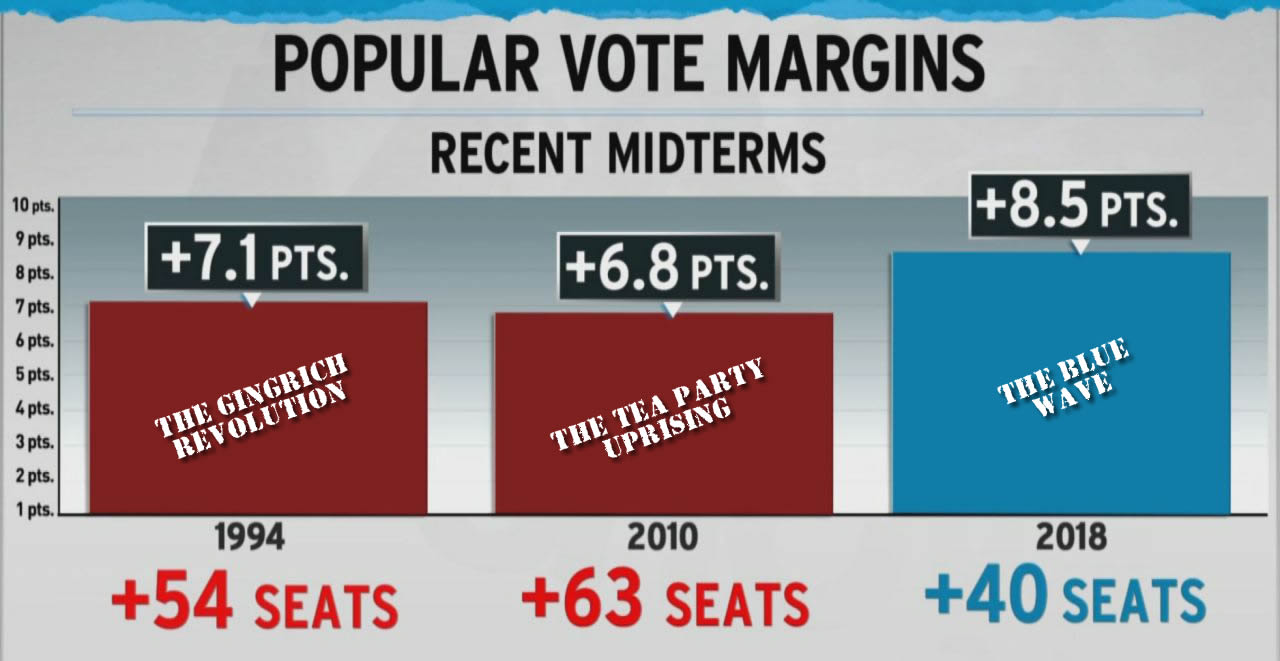

But that was 2017. Predictions for 2018 were a bit more scatter-shot: Most people predicted Democrats would retake the house, but few predicted a #BlueWave that early on. And Yes, it was indeed a “Blue Wave” despite the fact Republicans not only retained control of the Senate but actually gained two seats. It took an awful lot of GOP Gerrymandering to undermine the will of so many voters:

Forbes correctly predicted the Mueller investigation would still be going on by years end, and a sluggish Stock Market would encounter a “correction of at least 10% sometime during the year.” But they also predicted “Justice Stevens would not retire and deny Trump a second Supreme Court pick”, and Democrats would fail to retake the House.

After a bit of scrounging around the web, I’m finding that just about everyone avoided making any dramatic predictions for the U.S.. Even the far-Right Heritage Foundations stuck to only predicting “International” events (North Korea, Iran, Turkey) and for the most part, eschewed trying to predict what Trump would do… which is not surprising since trying to predict what our Toddler-in-Chief will do from one minute to the next is like trying to predict what any child with A.D.D. will fixate on next.

So let’s review my own predictions for 2018:

- Mixed: - Expect the price of oil to continue to rise in 2018 and depress the economy. - On the final day of 2017, oil closed at “$61.19/barrel”. And while it did climb to $76.73 by the end of October, OPEC panicked when U.S. gasoline prices hit a 4 year high of $2.61/gal in November and inflation nearly broke 3% in July. Both US and Saudi oil production increased, dropping the price of oil to an average of just $50.12/barrel and gas to a national average of $2.27/gal by years end. So for the first 10 months, I was absolutely right. I didn’t count on last minute intervention that would so dramatically affect the price in such a short amount of time. Half-credit.

- Wrong: As the Mueller investigation draws down on Trump, he [Trump] will respond by trying to make nice with Democrats. - I actually tried to give Trump the benefit of the doubt here. I forgot what a petulant snowflake he really is. Any rational person wouldn’t try to piss off their opponents, rile up the resistance and motivate them to come after you even more. Trump proudly ran for president on what a good negotiator he is. The Art of the Deal no less. But instead, he dug in his heels, continued to attack his political opponents… on BOTH sides of the aisle… and ended the year throwing a hissy-fit that shutdown the government because Democrats refuse to give him Billions of U.S. taxpayer dollars to waste on a costly & ineffective wall he repeatedly insisted “Mexico” would pay for. My bad.

- Right: Expect Democrats to retake the House and possibly even the Senate come November. - (I said “possibly” the Senate <wink>.) The Blue Wave resulted in Democrats retaking the House of Representatives by winning 42 House races to give them a 36 seat majority for 2019. And while Republicans picked up two Senate seats, there was great controversy surrounding how some of those seats were won. Dumb-as-a-stump Cindy Hyde-Smith had to go through a runoff election in (of all places) Mississippi to defeat her opponent after proudly declaring she be “in the front row” for if we brought back public hangings (aka: lynchings), and her public statements explaining herself fell flat. But her opponent was black and Trumpster rednecks flocked to her defense. The GOP had to get creative to defeat Senate Democrat Heidi Heitkamp, passing a last-minute rule that you can not vote if you don’t have a street address… a rule invented specifically targeting Native Americans, whom live on Reservations and made the difference in Heitkamp’s last narrow victory six years ago. There was no such law during the primary, creating much confusion and disenfranchising hundreds.

- Right: Expect an economic slowdown by years end (brought on by rising oil & gas prices. - As noted earlier, the price of oil & gas DID continue to rise and the economy DID begin to slow. And even with the eventual drop in oil & gas prices, Trump’s Trade-War with China (et al) and threat of a government shutdown sent the Stock Market into a tailspin on Christmas Eve (followed quick by an irrational record-setting 1000+ point gain right after Xmas for a near zero net gain.

- Right: When the deficit starts to explode, Republicans will use it as an excuse to cut entitlements and programs for the poor. - Almost on cue, Trump announced (right before Christmas) new restrictions to make it more difficult to get Food Stamps. And Trump’s third Chief-of-Staff in two years (Mick Mulvaney) bragged how Trump had proposed a budget that would “cut entitlement spending” (ie: “MediCare & Social Security”) as part of their plan to reduce the Deficit (created by their massive tax cut for the rich.)

- Wrong: Unemployment will be up by years end. - While I still expect a sharp increase in the unemployment rate early next year thanks in part to Trump’s shutdown, the economic slowdown, Trade War and Market instability, the Unemployment Rate is ending the year at a historic low of just 3.7%, below the 4.1% it was at when the year started, and far below the “6%” I feared we might see. Trump’s economy is still riding on the sugar-high of his massive tax cuts. We have yet to see the hangover of when the bill comes due. (I fear I might only have been slightly premature on that prediction.)

- Right: No wall. No progress on getting his idiotic wall. Trump has shutdown the government because Democrats are refusing to give him FIVE BILLION DOLLARS to pay for a wall he repeatedly insisted “Mexico” would pay for. They DID briefly offer him “$1.6B for border security” IF he’d restore DACA (protection for the “Dreamers”), but he said “No. It’s $5 Billion or nothing.” They tried again, offering him $1.3B (who’s teaching whom how to negotiate?) to try and avoid a Shutdown, but again he said No. Now Democrats aren’t inclined to give him squat. And the polls are on their side.

- Wrong: Trump’s approval rating will be below 30% by years end. - Despite the slowing economy and most people blaming him for the Shutdown, Trump’s approval rating is still an unfathomable 43% (down 5% since October.) I’ve been saying all year that the only thing Trump has left going for him is the strong economy, and should that go South, he’s going to be in deep doo-doo. But as for now, his numbers are still hanging in there.

- Right: Mueller might wait until after the 2018 mid-terms to announce anything significant regarding the case against Trump, [but] will release some controversial findings before the mid-term election. - Mueller has not yet started levying charges against Donald Trump, and he waited until after the midterms to sentence Michael Cohen and Mike Flynn. A few “revelations” came out during the year, but the most notable ones (Trump’s lie about never pursuing a “Trump Tower Moscow” not only turned out to be a lie, but he pursued it for far longer than he claimed. And news of corruption of “The Trump Foundation” didn’t come out until after the election as well.)

- Right: As controversy over GOP misconduct grows, Dem chances in the mid-terms improve. - Indeed, the Blue Wave was very much a result of people being fed up with a GOP that refused to hold Trump accountable for anything.

- Right: [Trump] will find ways to distract the public from the growing controversy swirling around his Russia ties. - Master of Distraction that he is, Trump always knows how to concoct a new controversy to distract people from the last one. Most recently, when Michael Cohen was sentenced to 3-years in prison and his former National Security Advisor was about to receive the same, Trump chose that time to spontaneously declare (in a tweet no less) without consulting anyone that “we had defeated ISIS and were pulling all of our troops out of Syria”… which I’m sure was music to Putin’s ears but prompted his Secretary of Defense to resign in protest (a U.S. first.) I wish I still had access to my old Facebook account because I must have posted the following image a dozen times last year every time Trump found a way to change the subject:

- Right (arguably): One of the revelations to come out of the Mueller investigation is Trump’s business ties to the Russian Mob. - While no one revealed a direct connection between Trump and The Russian Mob, ample evidence turned up that all sorts of criminal enterprises knew Trump was more than eager to turn a blind eye to the origin of hundreds of millions in criminal cash being laundered through Trump’s “legitimate” real estate empire (in violation of U.S. law.)

- Right: Republicans will grow increasingly desperate to discredit him. Possibly with Republicans launching an investigation of their own… into Mueller. - This one was a bit of a tough call because Congressional Republicans didn’t launch an “official” investigation into Mueller, but some Republicans were sufficiently worried enough about him to solicit a Vermont Law School professor to falsely claim she had been “sexually harassed” by Robert Mueller… someone she had never met. She described the email she received as “creepy” and forwarded it to the Special Prosecutor’s office.

- TBD: Will Bernie Sanders declare he’s running for prez again after mid-terms? I suspect he will. Senator Sanders has not yet “officially” declared his candidacy, but he has given every indication that he is certainly thinking about it, which is understandable considering he came in second behind former VP Joe Biden as the preferred 2020 Democratic candidate (both of whom came in behind “someone new”.) No score.

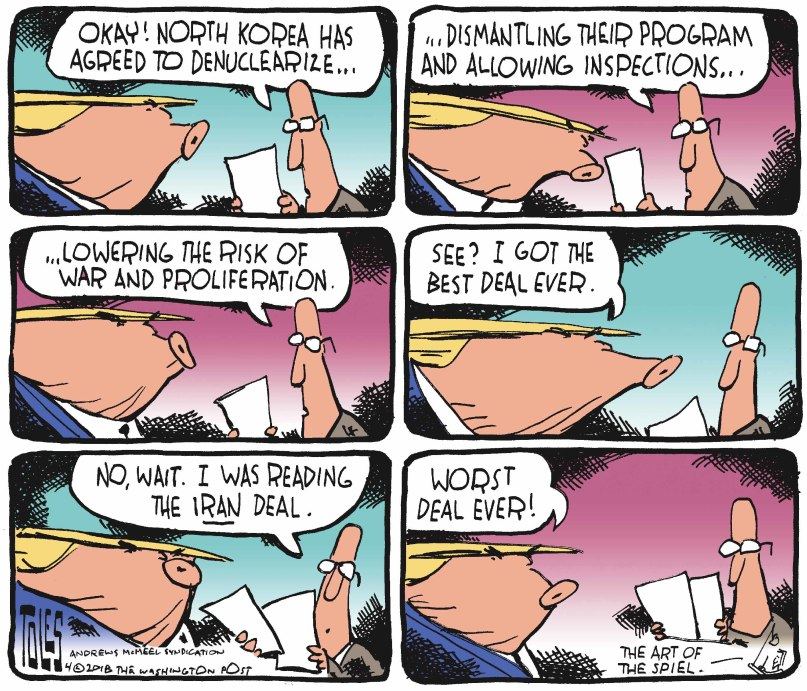

- Right: Cooler heads prevail and we see no significant conflict between the U.S. and North Korea in 2018. - It’s easy to forget that towards the end of 2017, tensions between the U.S. and North Korea were heating up with a flurry of provocative talk on both sides between two man-child leaders that crave attention and love talking big. But once the spotlight disappeared, so did their obsession with each other.

- Wrong: Michael Flynn will testify in open court. - While Gen. Flynn did indeed go to court to be sentenced following pleading guilty to lying to the FBI (among other things), he never testified. But the judge basically urged Flynn’s lawyers to reconsider sentencing him now until he had done more to mitigate his crime (of secretly representing a foreign nation while serving as National Security Advisor to the President of the United States after lying about that conflict of interests to the FBI.) But it may still happen. Watch this space.

- Mixed: Past tweeted statements [by Trump] will be used to contradict assertions he makes. - Like any Republican, when they become conspicuously indignant about something (like Bill Clinton’s affairs), just wait a bit and eventually you will discover they’re total hypocrites. And while Trump too has repeatedly proven himself a hypocrite many times over doing things he once criticized President Obama for doing, he has repeatedly falsely claimed he has said or done things that were contradicted by his own tweets (and typically video). For example, accusing Democrats of incorrectly believing his border wall “would be made of concrete”, only for video and a tweet to turn up of Trump on the campaign telling everyone “the wall will be made of concrete”. Or telling Chuck Schumer & Nancy Pelosi in a televised Oval Office meeting that “I won’t blame you if there’s a shutdown” [over refusing to pay for his border wall], only to then immediately blame Democrats for the Shutdown. But my thinking on this prediction was that buried deep in Trump’s tweet history, someone would uncover Trump admitting to doing something (like business with Russia) or being in a particular place/time when he was actually philandering with pornstars or some other activity connected to a crime he may be charged with. So in that regard, I was wrong. So this gets a “mixed” rating. Half-credit.

- Right: [Some] Democratic leaders will (stupidly) do their best to downplay the possibility of “impeachment” in the lead up to the 2018 mid-term election. - Nancy Pelosi already did this once before during the 2006 midterms, so it was no surprise some Democrats might do so again in 2018. Republicans in 1994 practically campaigned on impeaching Bill Clinton and won in a landslide. But wishy-washy Democrats think voters don’t want them to hold a criminal Commander-in-Chief responsible for what appears to be an ever-growing litany of crimes. Texas Senate candidate Beto O’Rourke was not shy about saying that he believed we should impeach Donald Trump, and ended up losing in deep red Texas by only 2.6%, putting the fear of God into his opponent Ted Cruz.

- Right: Puerto Rico will still be far from recovered from the devastation of the 2017 hurricane season. - I’m marking this one as right even though I predicted they might suffer additional damage in 2018. 2018 has ended with Puerto Rico STILL not fully recovered from being struck by Hurricane Maria in 2017. No additional recovery assistance has been forthcoming from the Trump Administration.

- Right: The war in Afghanistan will still be going on by years end. - A bit of a gimme, SEVENTEEN YEARS LATER, we are still no closer to getting out of Afghanistan than were a decade ago. World War II took two & a half long years to finally win. Vietnam ended in shambles after 10 long years with no strategy on how to “win” the war (and long after it was decided there was no way to win.) The war in Afghanistan is on course to last twice that long with no end in sight.

So how did I do? 14 right, 4 wrong with one TBD: 78%. I think that’s a record, exceeding my previous record of 73% set in 2015, and well over my 10 year average of 59.5%. Not bad. Not bad.

Okay, so on to my predictions for 2019 (in no particular order.):

-

- Trump will not participate in most (or perhaps any) GOP presidential debates. - 2019 will be the start of the 2020 Presidential Race. Around the middle of the year we will see the first Presidential Debates, and at least several Republicans will challenge Trump for the 2020 nomination… particularly if the economy starts to go South (or if criminal charges against him begin to mount.) Trump will initially say he will take part in the debates, and might even take part in one or two early on, but just as he once declared he “100% would testify under oath” in the Mueller probe only to eventually only agree to answer written questions, he will also promise to take part in any GOP debates only to eventually refuse.

(Sept 16: GOP starts canceling primary debates.) - The economy will reverse course sharply before the end of the year. - I’ve been warning people to expect this sometime in late 2019 or early 2020 since before I wrote this Op/Ed last May. There is an economic crash coming that will make 2008 look like an economic hiccup. Interest rates MUST rise to compensate for Trump’s massive tax cuts. We saw a dramatic rise in oil prices that wasn’t reversed until serious intervention by U.S. oil companies and OPEC to increase production. But lower oil prices hurt the profits of oil producers, so don’t count on them coming to Trump’s rescue over & over again. Trump and the GOP will blame Democrats for this turnaround (natch), falsely claiming the reversal began after they took power (2018 ended with the DOW in freefall due to Trump’s Shutdown threat and eventual closure, as well as the protest-resignation of Defense Secretary Mattis in response to Trump’s spontaneous announcement of our complete & total withdrawal from Syria, threatening international stability.)

- And it almost goes without saying that if the economy reverses course, Unemployment will jump. First due to the Government Shutdown taking place here at the end of 2018, and later due to interest rate increases and higher energy prices as Trump creates more instability in the Middle East. I was vastly over-estimating when I predicted a dramatic reversal hitting 6.0% by the end of 2018 last year, but I’m quite certain unemployment will be over 1% higher by the end of 2019 than it is as of this writing (3.7%).

- The first U.S. soldier born after 9/11 will die in Afghanistan (the amorphous “War on Terror”.) - A tragic and sad milestone never before seen in American history. By the end of the year, we will have been at war in the Middle East for longer than most new recruits have been alive. And tragically, it’s almost inevitable that one of them will die in combat. I can only hope that this person’s tragic death will be a wake-up call for millions of Americans who’ve grown numb to the fact we have been in a state of perpetual war for a generation. And if this does occur, it is likely to become a subject of debate during the 2018 campaign.

- Investigations of Trump will become more public. - To date, much of the Mueller investigation has taken place behind closed doors, and The Special Counsel’s office has done an amazing job of not leaking or responding to attacks that could reveal the status of their investigation (or allow anyone to paint it as “biased”.) But all that changes as the investigation begins to wrap up sometime in 2019, charges are filed, and Democrats in the House are freed up to reveal what they know and campaign on criminal prosecutions. Expect Trump’s most rabid supporters to go into deep denial… deeper than most already are… to the point of absurdity, as the walls start closing in. I’m not going to predict Trump’s Approval Rating by year’s end, but it will be low enough for the GOP to seriously debate whether or not he should be their 2020 nominee.

- If economy turns, even many Republicans will begin to support impeaching Trump. - And to that end as described in the prediction above, expect just enough Republicans (including pundits) to openly consider impeaching Trump, to put the fear of God into him. How he responds to that is anyone’s guess (but it will almost certainly be characteristically childish.)

- Hillary Clinton will NOT run again for president of the United States. - As the poll cited earlier (see: Biden reference above) shows, Hillary has the lowest “excited about” numbers and the highest “shouldn’t run” numbers of any major potential candidate of the 2020 election. Trump vs. Hillary? “Been there, done that, and we know how it turns out.”

- Someone most people aren’t currently talking about will become an early front-runner in the Democratic race as voters look for “someone new” to take on Trump. - Democratic voters are not particularly excited about any of their choices. What they REALLY want is someone with “gravitas” that can effectively call out Trump’s bullshit when he starts making crap up in a debate. Some potential dark horse candidates include Sen. Sherrod Brown of Ohio and Sen. Jeff Merkley of Oregon, though I wouldn’t place bets on either becoming overwhelming favorites without some help.

- And that help is likely to come in the form of Texas Representative Beto O’Rourke topping the list of every candidates’ shortlist of potential VP picks. - O’Rourke narrowly lost to Ted Cruz in deep red Texas. And a Democrat who could potentially bring in both California AND Texas is extremely attractive to many Democrats (though it wasn’t enough to help Mike Dukakis when he picked Texas Senator Lloyd Benson to be his running mate in 1988.) But in the end, O’Rourke DID lose his last race, and comes with some controversy of his own (chief among them, a claim he fled the scene of a traffic accident, supposedly the result of a DUI, when he was 26.) And we haven’t elected a Representative president since James Garfield in 1880 (I believe the ONLY person ever elected straight from the House to President.)

- Another potential dark horse candidate is General Stanley McChrystal, the former Commander of U.S. Forces in Afghanistan. IF he should decide to run, he would likely jump to the front of the pack, particularly following his very public criticism of his former boss on national TV last weekend, calling Trump “immoral” and “doesn’t tell the truth”. McChrystal is a Registered Independent and I know absolutely nothing about his politics, but he certainly has the gravitas and seriousness of someone I think could seriously worry Trump about his reelection prospects. But he would need to change Party’s, run as a Democrat, and impress millions with his debating skills to get the nod from most voters. Will he or won’t he? I’m not hearing any rumblings from him about potentially running, so at this point I think it is unlikely. But if he does, he’ll be an early favorite.

- Paul Manafort will not flip and start dishing dirt on Trump. He can’t. He’s terrified. Both the Trumpsters and Russia would ensure he (or someone close to him) died a horrible death should he implicate either side… and there’s no question he has the evidence to do so. Manafort was brought in to be Trump’s Campaign Manager specifically for his access to people (crime bosses, et al) with access to boatloads of dirty money. Russian (and Ukrainian) oligarchs, the Russian Mob, and the Russian government itself (his own business partner was Konstantin Kilimnik, Russian “political consultant” whom reportedly worked (works?) for the GRU (the Russian CIA.) But what he knows WILL come out eventually either in the form of documents, emails, phone calls or other records. Manafort is going to spend the rest of his life in prison… however long that may be.